Market intelligence report

Here we look at changes in the production volumes of Australian wool and where those changes are most pronounced, China’s dominance as an export destination of Australian wool, and we take a special look at India.

Australian wool production volume by weight

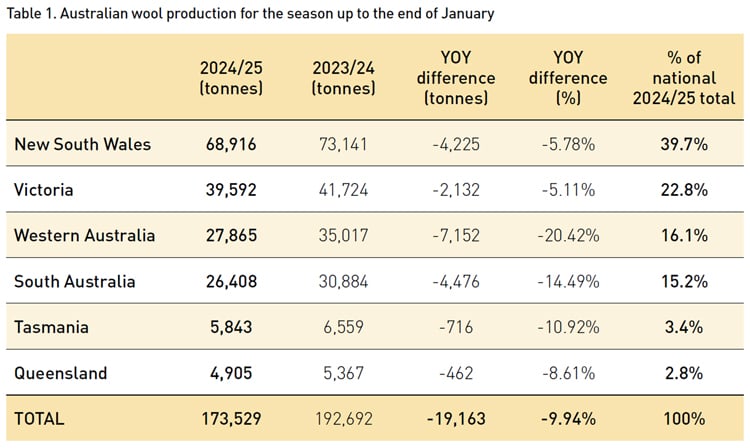

Australian Wool Testing Authority (AWTA) Key Test Data for the 2024/25 season up to the end of January shows that the volume of Australian wool tested dropped by almost 10% compared to the volume tested during the same seven months of the previous season, which is a decrease of just over 19,000 tonnes or about 106,000 bales.

If the average monthly volume tested so far was applied to the whole 2024/25 season, the annual figure would be about 297.5 mkg, a shortfall of 11.1% on the previous season. This would see 1,662,000 bales flow through the AWTA for the season.

The largest drops in wool production have been in Western Australia and South Australia. Whilst adverse climatic conditions have played a major role in the reductions of wool being grown, Western Australia has additionally been influenced by government legislation which has forced landowners there to assess the inclusion of sheep in their enterprises going forward.

The production volumes of the two largest wool producing states, New South Wales and Victoria, have been far less impacted, despite some regions in the two states experiencing continuing dry conditions. Even though both of these two states have less wool being tested, the losses are restricted to about half of the national 12.0% fall predicted by the Australian Wool Production Forecasting Committee (AWPFC) in its December report. This is somewhat helping hold overall Australian volumes.

The latest AWPFC forecast of shorn wool production for 2024/25 is 279.4 mkg greasy, a 12.0% decrease on the 2023/24 forecast. The number of sheep shorn is forecast at 63.2 million, down 11.7%.

Australian wool production volume by micron

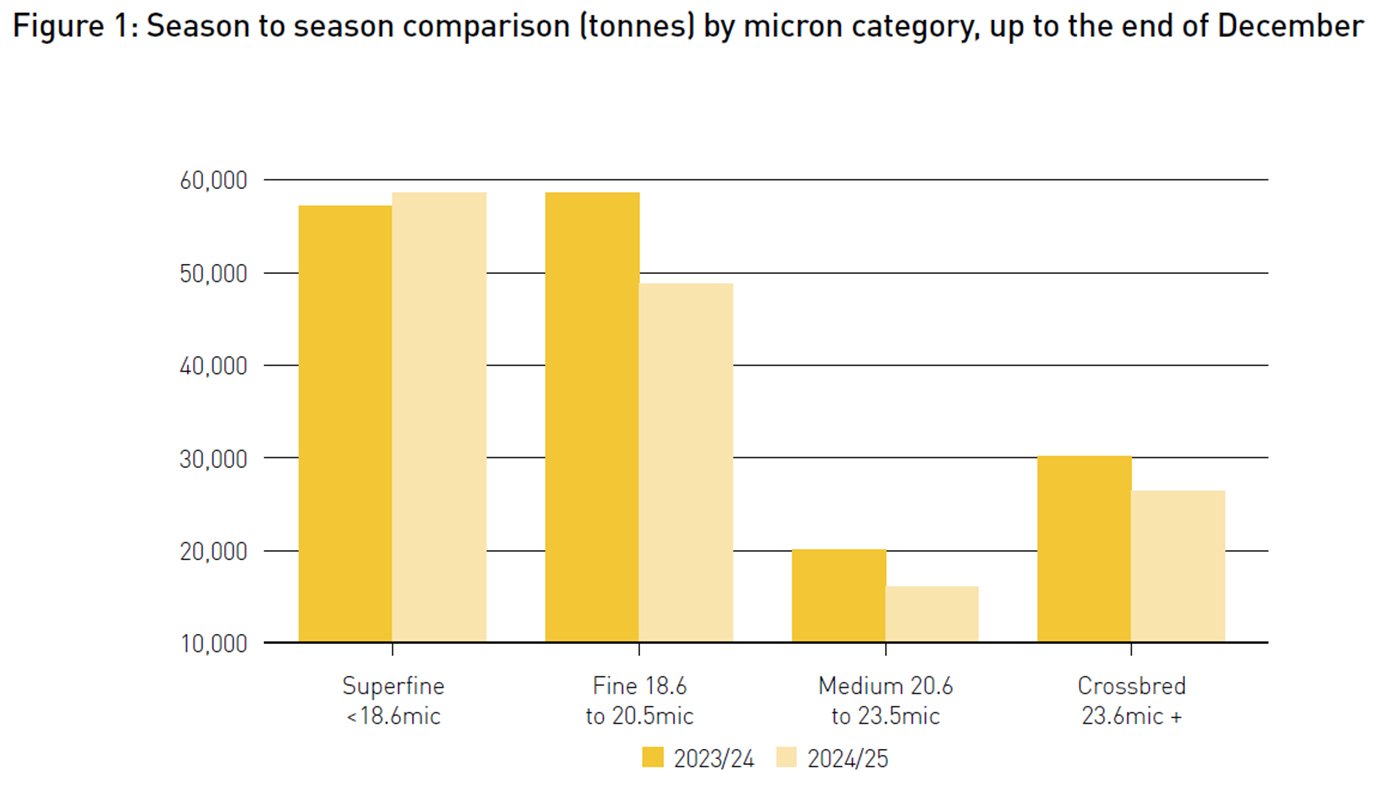

The first six months of AWTA testing for the 2024/25 season has produced some quite unexpected results. The only category to show increased production volume is the superfine Merino sector of 18.5 micron and finer which has grown by 2.3% year on year. Dry conditions may be a prime factor, with Western Australia, South Australia, Tasmania and Victoria all affected.

All the other micron sectors have seen falls in production volume that exceed the current average national 9.8% loss (up to the end of December 2024) and the AWPFC full season estimate of a 12.0% loss. Fine Merino wools of 18.5 to 20.5 micron have tested 16.6% less wool so far this year; medium wools of 20.6 to 23.5 micron are down 20.1%; and perhaps the most unexpected is the coarsest wools and crossbred area of broader than 23.5 micron which is 12.7% down compared to the same stage of last season.

Australian wool exports

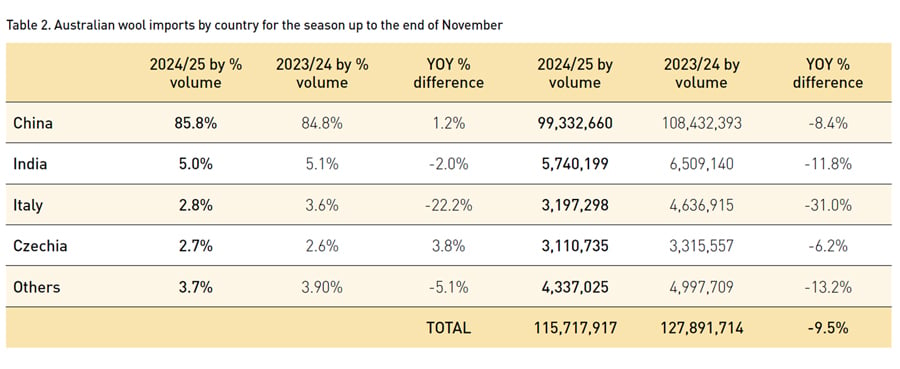

According to Australian Bureau of Statistics (ABS) data up to end of November 2024, China remains the dominant importer of Australian wool. Compared to the same point of last season, China’s share of all Australian wool increased by 1.2% to 85.8%, even though the total volume imported by China is 8.4% lower.

Export volumes are currently 9.5% lower than the previous season, up to the end of November, which is similar to AWTA key test data which has dropped 9.8% for the same period.

All importing nations for the first five months of the 2024/25 season have seen much lower volumes of Australian wool being imported. The largest drop off for our major manufacturers comes from the 31% less wool that Italy has imported thus far.

FOCUS ON INDIA

Trade update

Raw wool imports by India have surpassed pre-Covid levels to reach 92.2 million kgs in 2023-24, of which 18% is from Australia. Most wool yarn manufacturers have indicated increased enquiries and orders compared to the past 8-10 months. They hope the momentum will grow in the coming months. Indian textile and apparel manufacturers continue to receive 10-20% increased orders, mostly due to the unsure Bangladesh political situation.

Global brands see India as a reliable sourcing destination that provides integrated sourcing solutions. The large capacity garment manufacturers are the largest beneficiaries.

Winter wear sales quickly picked up in mid-December due to a sudden drop in temperature in Northern India. This unpredictable weather impacted the inventory and sales plans of brands, as November did not have a temperature drop as expected which impacted sales which is usually at full price.

Economy update

India ranks first in terms of population and fifth in terms of economy worldwide as of 2023, according to Global Data. India's GDP growth in 2025 is estimated to be 6.4%, the fastest among all other major economies. The inflation rate currently stands at 5.22% whilst unemployment is running at about 8%.

India’s economic outlook underscores changing consumer spending trends among the growing middle-income group. As middle- to high-income households see increased disposable incomes, this trend is expected to boost economic growth and consumer spending. Real household expenditure is projected to grow at an average annual rate of 6.9% in 2024–25. India intends to strengthen its global manufacturing capabilities, with planned investments set to drive economic growth.

As of December 2024, India's market capitalisation was US$5.1 trillion. This was an 18.4% increase from 2023, making India the third-largest stock market in the world.

According to the REN21 Renewables 2024 Global Status Report, India is the world’s third-largest energy-consuming nation. India is fourth globally in installed renewable energy capacity, including large hydro. Additionally, India ranks fourth in wind power capacity and fifth in solar power capacity.

This article appeared in the Autumn 2025 edition of AWI’s Beyond the Bale magazine that was published in March 2025. Reproduction of the article is encouraged.