Market intelligence report

The 2023/24 selling season has so far seen the EMI in AUD remain steady, with a small rise from 1126ac/clean kg at the start of the season to 1137ac/clean kg on 30 May 2024.

Forecast production volumes

2023/24 season

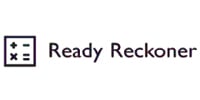

The Australian Wool Production Forecasting Committee (AWPFC) in April updated its forecast of Australian shorn wool production for the current 2023/24 season to be 324 million kilograms (Mkg) greasy, which is 1.0% lower than the 2022/23 estimate and a 4 Mkg downward revision of its previous forecast in December.

The number of sheep shorn during 2023/24 is expected to remain very near the 2022/23 season level of 71.6 million head at 71.5 million. Average cut per head is expected to be 4.53 kg greasy, down 2.2% compared to 2022/23.

Australian Wool Testing Authority (AWTA) key test data shows no change in mean fibre diameter (20.8 microns) or vegetable matter (2.2%), a 2.1 mm decrease in staple length to 87.5 mm and a 0.6% reduction in yield to 65.8%.

2024/25 season

The AWPFC’s first forecast of shorn wool production for the 2024/25 season is 306 Mkg greasy. This is a 5.8% decrease on the expected 2023/24 season final estimate.

A reduction in the number of sheep shorn (down 6.0%) is expected in most states but particularly in Western Australia and Victoria. Uncertainty surrounding the seasonal outlook and lower gross margins for sheep and wool production compared with alternative enterprises have impacted sentiment among producers which contributed to the reduced forecast of shorn wool production for the new season.

Season production by fibre diameter

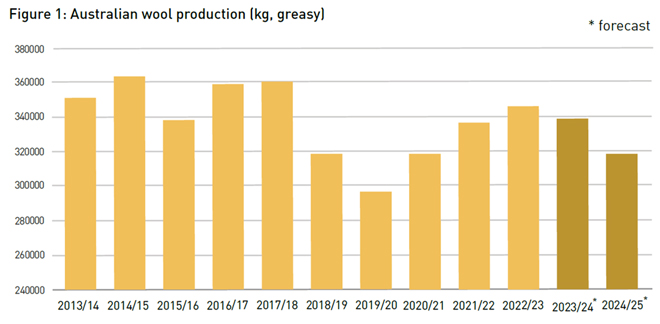

At the three-quarters point of the current season, the fibre diameter distribution of the national clip is enlarging at both ends of the micron spectrum. Production gains of 11.4% has been recorded at the finest (less than 18.5 micron) end of the spectrum. The broadest wools of greater than 23.5 micron have increased 6.6%. The downside of the production data is in the mid microns.

Fine wool Merino of 18.6 to 20.5 micron has dropped 4.2% of its percentage share, but the biggest loss has been in the Medium wool sector between 20.6 and 23.5 micron which has seen its percentage share of the clip drop by 17.8% year on year.

The lower wool cutting crossbred section of the clip is growing in percentage terms of the clip which leads to more animals cutting 2.5 kg versus 5 kg per head of the Merino breed. The anecdotal reports from the past five years that Australian farmers are turning to meat sheep is now evidenced by the data.

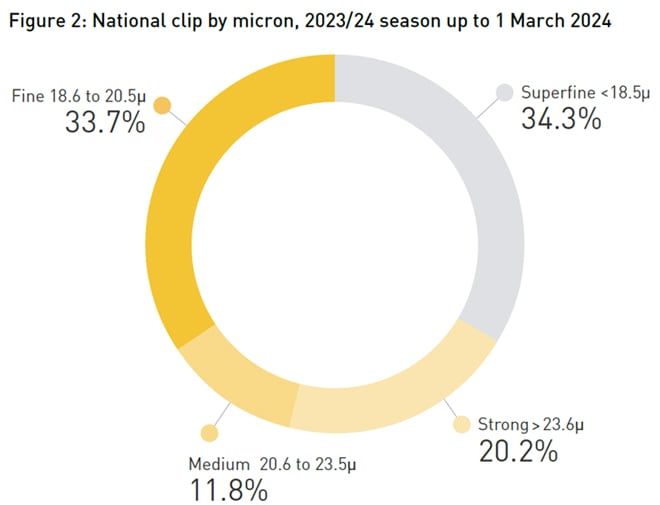

The broader than 23.5 micron wools now contribute 20.2% of volume to the national clip so far this season. If this holds through till season’s end, it will be the highest percentage share for more than a decade or two.

Wool price movements

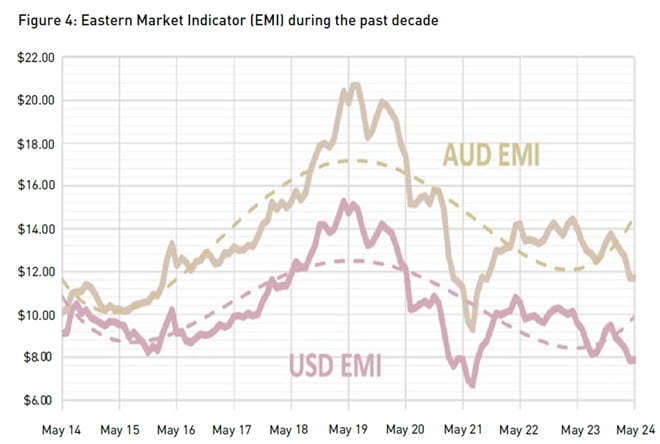

Price levels for wool when measured by the Eastern Market Indicator (EMI) in US dollars are now the most attractive for manufacturers and end users for a decade – apart from a four month period within the pandemic influenced market of 2020. The US dollar prices do remain the key indicator of wool demand. Local Australian dollar prices are holding value relatively better, but the current auction levels are predominantly influenced by the weaker Australian dollar rate of exchange against the US dollar.

Aspirational luxury shoppers have been forced to curb spending due to the high inflation and macroeconomic issues plaguing wool’s major consumer markets in North America and Europe. Shoppers are prioritising essential items and boosting savings. Therefore the higher priced wools – the finest – have suffered the greatest since the commencement of the 2023/24 selling season.

In China, this demographic has also been the most impacted. The ongoing real estate crisis and stock market devaluations are the primary reasons spearheading the drop offs in spending in that nation. Whilst these economic issues are set to gradually improve in coming years, they may have lingering effects on consumer confidence.

In comparison to the entire Merino sector, the crossbred wool types have staged a price recovery since the start of the season, albeit from a very poor, low price basis.

Alternative fibre price comparison

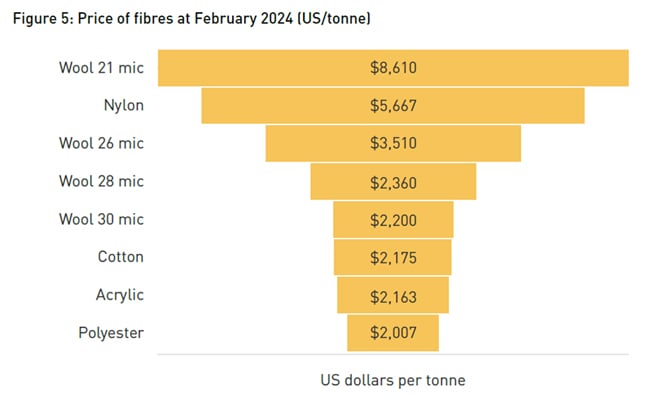

The past 12 months has seen the price of most of the extruded synthetic fibres and cotton alternatives to wool fall below the crossbred wool values.

Since the pandemic, these crossbred wools of 26 to 30 micron had been sitting underneath the values being paid for cotton, acrylic and polyester, but now are surging above their competing fibres as synthetics and cotton fall and crossbred wool regains some favour in the textile business.

Export destinations for Australian wool

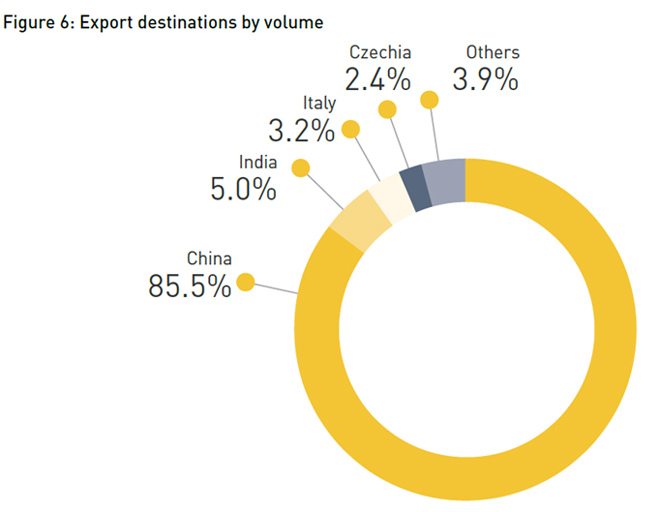

Not unsurprising, the 2023/24 season has seen the Chinese import of Australian wool grow even further. Current export data show that 85.5% of all Australian wool flowed through to China. That compares to last year’s completed season figure of 82.6% by volume.

India is running at 24% less weight imported from Australia as a percentage of the total exports so far this season compared to last season’s total share.

Italy is currently running at 12% lower import levels than last year whilst Czechia is just 7% short of last season’s market share of exports.

This article appeared in the June 2024 edition of AWI’s Beyond the Bale magazine. Reproduction of the article is encouraged.