Big opportunities for wool in Latin America

AWI has been exploring opportunities to increase the manufacture of Australian Merino wool products in the Latin American countries of Mexico and Peru, both of which have strong textile production capabilities and excellent market access to the USA.

As part of the development of its Emerging Markets Strategy to diversify the Australian wool supply chain and find new markets for the fibre, AWI last year researched the potential for increasing the production of Australian wool products in Latin America.

The research identified a large textile manufacturing base in the region, from early stage processors to garment producers, that have the capacity, economic influence, proximity to consumer markets, and eagerness to grow their wool offering. In addition, brands and retailers in the USA are increasingly interested in sourcing their goods from closer to their consumer markets to reduce logistical risks, lead times and their carbon footprint.

From its research, AWI identified Mexico and Peru as the two countries in Latin America that have the most potential to increase the region’s Australian Merino wool use, thereby providing opportunities for diversification of the wool supply chain for brands and retailers, especially those operating in the USA market. Ultimately, this would bolster the demand for Australian Merino wool which will benefit Australian woolgrowers.

AWI through its subsidiary The Woolmark Company, and local contracted experts, have recently been working in the two countries and identified concrete business opportunities and the potential for new demand for Australian wool in these two countries.

Mexico

AWI R&D Commercialization Manager, Americas, Sarah Schlenger, with Woolmark consultant Jorge Plata (right), pictured with Martin Urrutia Z, President of Santiago Textil, the very first Mexican Woolmark licensee – together holding the original licence presented to the company in 1966.

Mexico is a key country in this region whose textile sector can meet the required service levels, delivery times and quality. The country has strong logistics, efficient supply chains, low levels of trade bureaucracy and dependable utilities within its special economic zones.

Mexico has many free trade agreements and their market is one of the most open and competitive in the world. The United States–Mexico–Canada Agreement (USMCA) is the most powerful of Mexico’s trade agreements, promoting US investment in Mexico’s apparel industry.

The USA is Mexico’s largest importer of textiles and apparel (85% of the market). Transport to the USA takes between one and four days, and 22 to Europe.

The Mexican textile industry is pivoting away from domestic markets and increasingly regarding the export of luxury and performance products as the industry’s future.

Textile manufacturers in Mexico are asking The Woolmark Company to connect them with downstream customers, upstream fibre and material suppliers, and provide them with training about wool processing and wool manufacturing.

Peru

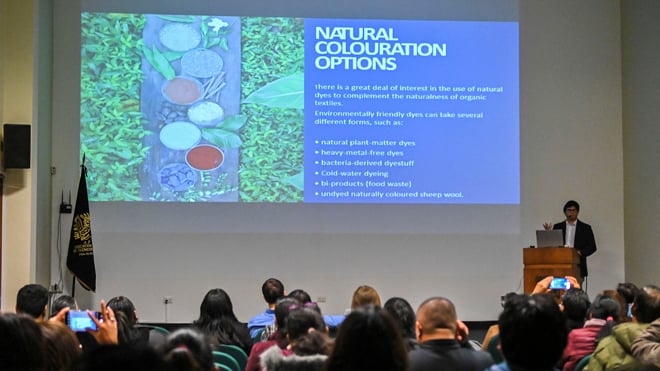

The Woolmark Company consultant, Juan Carlos Aragon, delivering a presentation to the Peruvian Association of Textile Technicians on processing innovations with Australian Merino wool.

Peru has the potential for high quality production, quick speed to market, advantageous free trade agreements, and broad manufacturing capabilities. The country has the full production chain within its borders to produce a wide variety of products, from large quantities and bulk production to small-batch, slow fashion.

Nearly 80% of Peru’s apparel exports go to the Americas, with 50% to the USA. Peru has preferential trade agreements with 53 countries including the USA, EU, and China.

The country has reliable energy, transportation, and trade across its borders. Its lead times vary from 30 to 60 days. Typical shipping times are 11 days to the USA and 18 to Europe.

The Peruvian textile industry is oriented towards major luxury fashion and sportswear brands. The focus on sustainability by these brands and local manufacturers presents a significant commercial development opportunity for Australian wool.

The Woolmark Company has experienced a very positive reception in the country, with opportunities identified in key market sectors for both knit and woven fabrics, including for 100% Australian wool products and also blends with pima cotton and alpaca.

Current Woolmark in-kind activities

The Woolmark Company and its consultants in the region currently provide in-kind support to the textile supply chain in the two countries, including:

- Identifying opportunities for building new supply chain connections.

- Identifying opportunities for technical transfer to the countries’ processors/manufacturers.

- Providing wool education to designers and suppliers.

- Translating training modules into Spanish.

- Assisting suppliers to provide swatches for The Wool Lab sourcing guide.

- Promoting wool at industry trade events.

- Providing interviews with the trade media.

- Identifying potential companies for Woolmark licensing.

- Increasing the region’s applications in the International Woolmark Prize and Woolmark Performance Challenge talent development programs.

This article appeared in the September 2024 edition of AWI’s Beyond the Bale magazine. Reproduction of the article is encouraged.