Market intelligence report

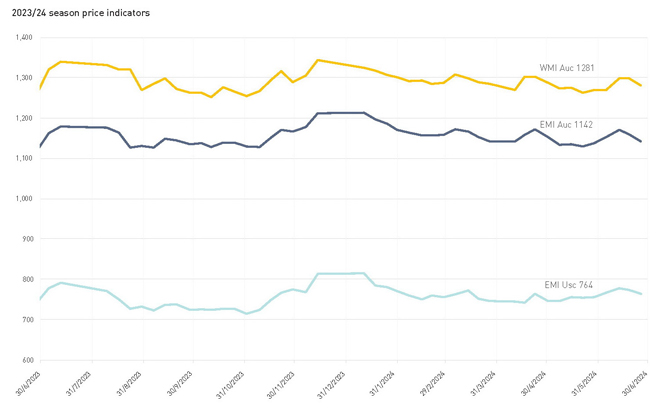

The 2023/24 selling season has seen the EMI in AUD remain steady, with a small rise from 1126ac/clean kg at the start of the season to 1142ac/clean kg at season’s end.

2023/24 season production volumes

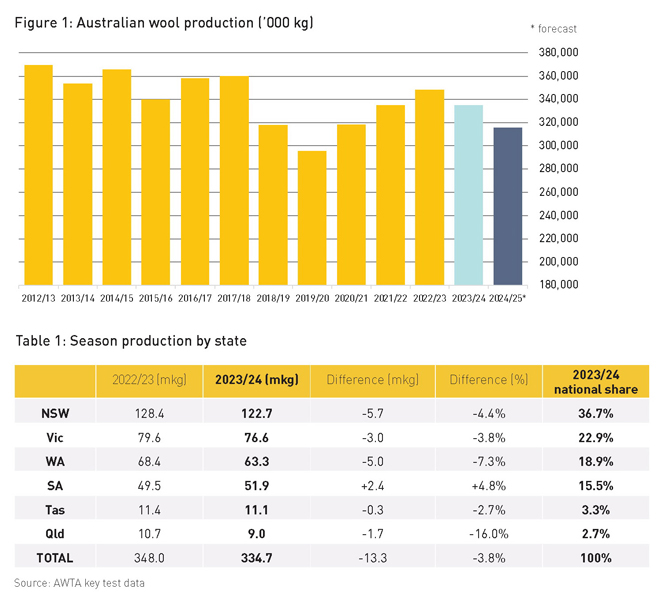

The Australian Wool Testing Authority (AWTA) tested 334.7 million kilograms (mkg) of Australian greasy wool for the recently completed 2023/24 season, which is a drop in production of 3.8% compared to the previous season’s 348.0 mkg.

Given the Australian Wool Forecasting Committee has forecast a 5.8% drop in production for the current season, this suggests the AWTA key test data will total about 315 mkg for 2024/25.

NSW was the state that had the largest drop in volume in 2023/24, with its production falling 5.6 mkg (a 4.1% drop) compared to the previous season. However, NSW remained the dominant wool producing state and provided well over a third (36.7%) of the national volume by weight of wool tested for the 2023/24 season, a similar percentage to the 36.9% that NSW recorded the previous season.

WA was the state with the second largest drop in volume, down 5.0 mkg (7.3% drop) in 2023/24; the WA share of the national clip fell to 18.9% in 2023/24 after being 19.6% of last season’s total. Queensland was the state with the highest percentage drop in volume, a 16% drop (1.7 mkg). South Australia was the only state to record an increase, a 4.8% increase or 2.4 mkg.

2023/24 season production by fibre diameter

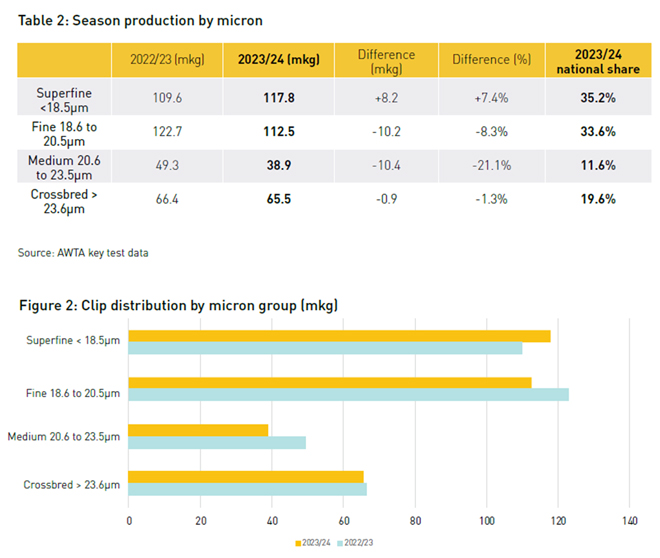

Fibre diameter is the primary influencer of price returns. The seasonal data quite clearly shows a trend of woolgrowers targeting the higher priced superfine wool production zone, whilst anecdotally trying to retain wool cut/ha. This in theory is good for total clip value and GDP.

Production gains of 7.4% have been recorded year on year on the superfine and ultrafine Merino (less than 18.5 micron) wool types. This is the only wool sector where gains have been registered.

The largest loss of wool type production has been in the Medium wool sector (20.6 to 23.5 micron), which has seen its percentage share of the clip drop by 21.1% year on year. By weight though, the loss is equivalent to the fine wool’s drop in production which is a touch over 10 mkg in both the wool fibre diameter sectors.

The broadest – generally crossbred – wools of greater than 23.5 micron have decreased by 1.3% season to season, although the percentage share of the clip of crossbred grew from 19% to 19.6%.

2023/24 volume by auction throughput

Wool selling at auction at the end of the 2023/24 selling season has seen:

Offered: There were 2.8% fewer bales (52,318, approx. 9.4 mkg) offered at auction in 2023/24 compared to the previous year: 1,797,792 bales (approx. 321.8 mkg greasy) offered in 2023/24 compared to 1,850,110 bales (approx. 331.2 mkg) offered in 2022/23.

Sold: There were 3.2% more bales (51,698 bales, approx. 9.3 mkg) sold at auction in 2023/24 compared to the previous year: 1,659,497 bales (approx. 297.1 mkg greasy) sold at auction in 2023/24 compared to the 1,607,799 bales (approx. 259.8 mkg) sold in 2022/23. A$2.24 billion was sold through the auction system in 2023/24 compared to the A$2.42 billion in 2022/23, a 7% fall in gross raw wool value of approximately A$180 million for the past year.

Clearance rate at auction in 2023/24 was 92.3% nationally of all wool offered sold, compared to the 86.9% cleared in 2022/23. Whilst offerings were down slightly, more wool was sold. The selling intent of growers was also far more prevalent, and saw an improvement rate of 6.2% of wools being offered being sold.

Export destinations for Australian wool

With just a month left of data from the ABS (Australian Bureau of Statistics) to be added for the 2023/24 season, China has so far imported 86.4% of the Australian clip. In dollar value, China has imported 84.0% of the Australian clip.

Whilst Italy’s volume share is very low at just 2.7%, it is 5.1% of the value when looking at export earnings. It is still quite a disappointing figure, because earnings from the Italian import are usually well above 12% of the export value. India has imported about 5% of the clip by both volume and value. Exports to Czechia are heavily weighted towards crossbreds so the volume figure sits well above the dollar value.

There are a total of 13 countries that receive greasy wool, but in a commercial sense, that destination list drops to six significant and viable users given our volumes produced. For the current season, Australia has exported 96.3% of its wool (by weight) in the greasy, raw form. 1.2% is scoured wool and 2.5% carbonised. 29 countries have received exports from Australia this current season in all wool forms, either greasy or semi processed.

2023/24 wool price stability

The past season could only be described as average, with possibly one of the least fluctuating price ranges seen in many years. The lowest Eastern Market Indicator (EMI) of the season was at the commencement of the season at 1126ac, with the top weekly closing EMI of 1213ac in the first week of the new 2024 calendar year. This was an intra seasonal difference of just 87ac, with a trading range of just 3.8% around the mean.

The 2023/24 season saw the EMI in AUD appreciate from 1126ac/clean kg to conclude at 1142ac/clean kg. This is an intra seasonal gain of 16ac/clean kg or 1.42% in Australian dollar terms. The season averaged an AUD EMI of 1155ac/clean kg.

The USD EMI gained 16usc/clean kg from 748usc/clean kg at the start of the season to conclude at 762usc/clean kg. This is a seasonal gain in USD of 16usc or 2.14%, slightly outperforming the Australian dollar value gain. The season averaged a USD EMI of 755usc/clean kg.

The 2023/24 season saw the Western Market Indicator (WMI) in AUD gain 9ac/clean kg to 1281ac/clean kg after opening the selling year at 1271ac/clean kg. This is an intra seasonal gain in the AUD WMI of 0.79%. The AUD WMI averaged 1291ac/clean kg for the season.

This article appeared in the September 2024 edition of AWI’s Beyond the Bale magazine. Reproduction of the article is encouraged.